Pipe Business Card

Better spend management

is in the cards

Launch an embedded card program* and help your customers manage day-to-day spending with a turnkey and customizable solution designed with your customers in mind.

01

Fast

Launch a branded business card program for your customers in days instead of months

Streamline launch with multiple integration options and revenue-based underwriting

Themeable cards and customizable rewards tailored to fit your brand

Quick underwriting lets you support as many of your customers as possible

02

Easy

We handle the underwriting, compliance, capital markets, risk, and fraud management

Pipe handles risk, fraud, and compliance so you don’t have to

US-based customer success team handles dispute management and resolution

Customized underwriting models based on customer revenue data

03

Scaled

Launch a new product and revenue stream without the distraction of building in-house

Revenue share for you and cash back for your customers

Boost retention by deepening the relationship with your customers

Help your customers grow with access to capital

04

Integrated

Get a 360 view of your customers' business and leverage spend insights to grow your share of wallet

Enable customers to pay for expenses like travel, inventory, and utilities directly from your platform

Gain share of wallet and spend insights on your customer base

Integrate a suite of financial products to become a one-stop solution for your SMB customers

A better way to simplify spending and manage business expenses

Give your US-based customers access to Pipe’s frictionless card issuing, embedded natively in your platform and customized to match your brand.

Customer friendly

A friendly card program designed with your customers in mind

Give your customers more flexibility with their cash flow while handling day-to-day business expenses, with additional benefits including:

No annual fees, no personal guarantees, no credit checks

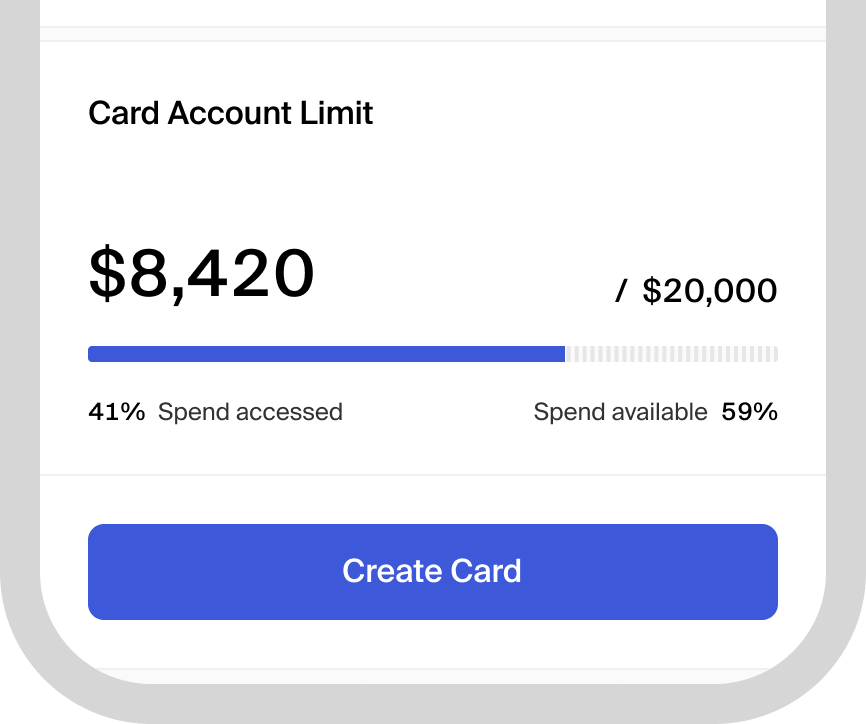

Unlimited virtual and physical cards with custom spend rules

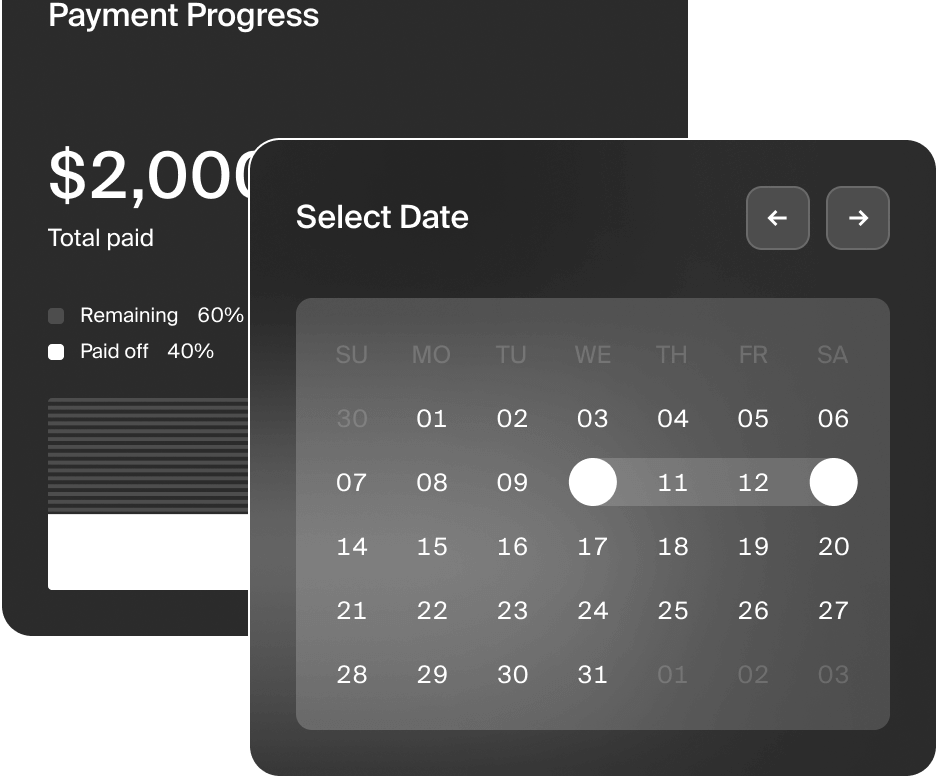

Up to 45 days to pay for everyday business expenses

Cash back earned for every purchase**

Multiple integration options

Choose from three customer experience options

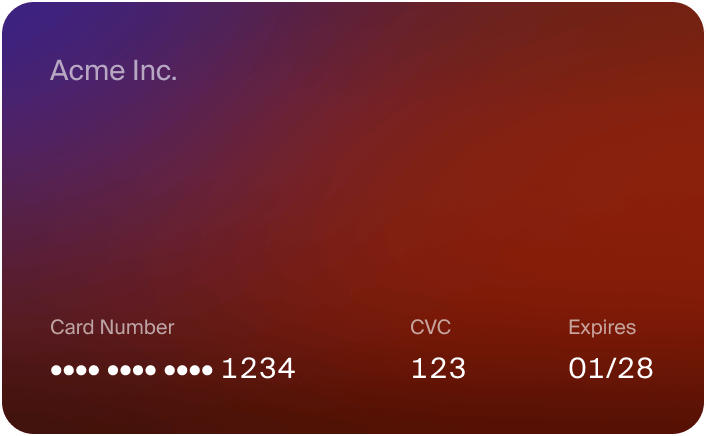

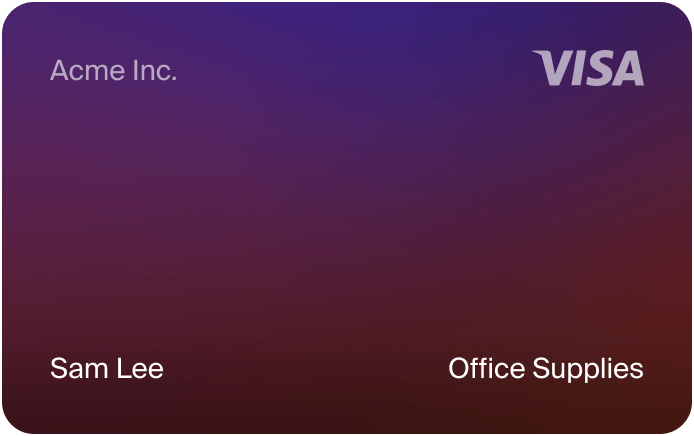

Fully Themable

Easily customize the look and feel to match your brand

Our customizable cards are the perfect way to create an ownable touchpoint for your brand while supporting your customers’ success.

*Pipe Business Cards are issued by First Internet Bank of Indiana, Member FDIC, pursuant to a license from Visa® Inc and may be used everywhere Visa credit cards are accepted. The Pipe Business Card is a pay-in-full charge card. Your Statement Balance must be paid in full 15 days after the close of your statement period. Any outstanding statement balance will be automatically debited from your designated payment due date. If a payment fails, your card will be locked and a percentage of your daily sales will be collected until your balance has been repaid in full.

**Cash Back refers to rewards earned as a percentage discount on eligible purchases.

Card product is provided by Pipe Licensing LLC. View our state licenses.

FAQs